Available Mortgage Loan Types:

Fixed Rate Mortgage

A Fixed Rate Mortgage is the go-to choice for those who value stability and predictability in their financial planning. With this type of mortgage, your interest rate stays the same throughout the entire loan term, whether it's 15, 20, or 30 years, ensuring your monthly payments never change.

It’s perfect for setting down roots and budgeting with peace of mind, especially if you're planning to stay in your home for the long haul.

Adjustable Rate Mortgage (ARM)

An Adjustable Rate Mortgage, or ARM, starts you off with a lower interest rate that's locked in for a set initial period, making it an attractive option for those looking to save upfront.

However, after this honeymoon phase, the rate fluctuates with market trends, meaning your payments can go up or down. It's a bit of a gamble, but it can be a smart move if you're planning to sell or refinance before the rate adjusts, or if you're expecting your income to increase in the future.

FHA Loan

This is a fantastic option for first-time homebuyers or those without a lot of cash for a hefty down payment, offering down payments as low as 3.5% and being more lenient on credit scores.

But here's the catch: You'll be paying for PMI, or Private Mortgage Insurance, for the life of the loan, which adds to your monthly costs. It's a trade-off for easier entry into homeownership, especially if your financial past has a few blemishes.

VA Loan

A VA Loan is like a thank-you note from Uncle Sam to our veterans and active military, offering some of the best perks in the mortgage world. With no down payment required, no PMI, and typically lower interest rates, it's a fantastic deal for those who have served.

Just remember, there's a VA funding fee, but considering the benefits, it's a small price to pay for those who've given so much.

USDA Loan

This is like a hidden gem for those looking to plant roots in rural or certain suburban areas, often overlooked but incredibly valuable. With zero down payment required and lower interest rates, it’s a great option if you meet the geographical and income criteria.

Just a heads up, though – you'll need to pay a guarantee fee, similar to PMI, but the overall affordability makes it a sweet deal for qualifying homebuyers. Keep in mind that income from everyone in the household will be included in order to qualify.

Jumbo Loan

A Jumbo Loan steps in when you're eyeing a property that's a bit more, let's say, 'grand' than your average home, exceeding the conventional loan limits set by Fannie Mae and Freddie Mac.

These loans come with their own set of rules – think higher credit scores, larger down payments, and a more rigorous underwriting process. It's the high-stakes game of the mortgage world, ideal for luxury properties or expensive housing markets, but you'll need to bring your A-game to qualify.

Interest Only Loan

An Interest-Only Loan is a bit like a tightrope walk in the mortgage world – it offers lower initial payments because you're only paying the interest for the first few years. It's a nifty option if you're expecting a future cash windfall or planning to sell before the balloon payment hits.

But tread carefully, as once the interest-only period ends, you're looking at higher payments since you'll start paying down the principal.

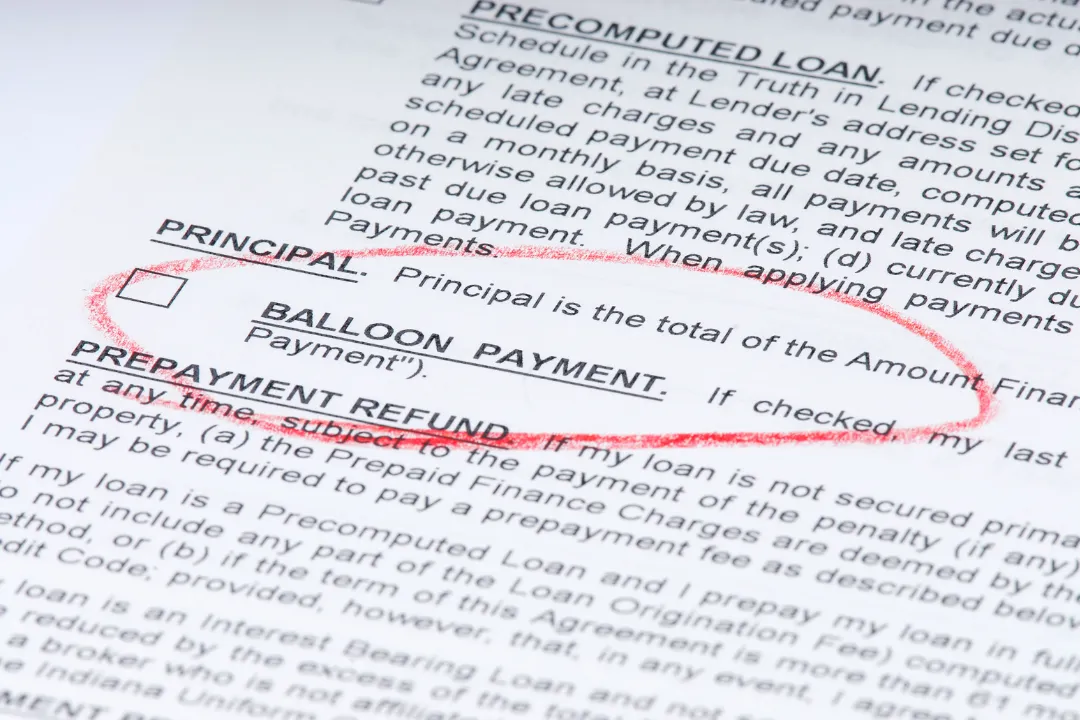

Balloon Mortgage

This is kind of like a short-term fling with long-term consequences – you get lower monthly payments for a set period, typically 5 to 7 years, but then comes the big catch: a large 'balloon' payment at the end. It's a gamble that can pay off if you plan to sell or refinance before the balloon payment is due.

But be warned, if your plans don't pan out, you could be facing a hefty sum to pay off all at once.

Reverse Mortgage

A Reverse Mortgage flips the script on traditional home loans – instead of you paying the lender, the lender pays you, based on your home's equity. It's a nifty option for seniors over 62, turning their home equity into cash without having to sell.

Just keep in mind, the loan comes due when you move out, sell, or the last borrower passes away, so it's a choice that needs careful consideration for the long-term impact on your estate.

Construction Loan

A construction loan is a short-term, higher-interest loan that provides the funds necessary to build a residential property. Unlike a traditional mortgage, it covers the cost of building a home and is usually converted into a regular mortgage after construction is complete.

It's perfect for those looking to build their dream home from scratch, but keep in mind, it requires detailed plans and a reputable builder – it’s not your average home buying process!

Renovation Loan (203K FHA)

This type of mortgage is offered by the Federal Housing Administration (FHA) and allows homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage.

Interest rates can be a bit higher with these types of loans. They're great for turning a fixer-upper into your dream home, but it requires careful planning and understanding of the process.